Can I Insure a Modified Vehicle?

Insurance is something everyone needs but no one wants to pay for. Shelling out a big chunk of change every month for an essentially invisible service seems like a gross financial burden until you actually need it.

This is especially true of car insurance. Maybe you’ve never had an accident or perhaps you haven’t even been pulled over since Regan was in the White House, but no matter how cautious you are having good insurance is a smart decision.

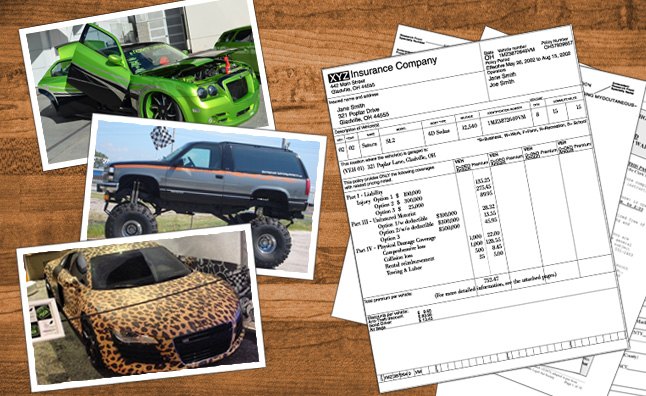

And all of this is fine and good if you drive a showroom-fresh Toyota Camry, but what if your car isn’t stock? What if it’s got modifications? Here are some guidelines to make sure your upgraded ride is covered.

To get some answers we talked to Andrew Smidt, underwriting manager at Farmers Insurance about coverage for aftermarket-enhanced vehicles. Surprisingly there’s actually good news for enthusiasts with upgraded cars and trucks. He said, “Our standard auto policy is designed to insure vehicles that are factory built,” but, he said they are still able to offer coverage for vehicles with “minor modifications.”

Smidt said the standard Farmers auto insurance policy typically covers up to $1,000 worth of modifications. But he also cautioned that it depends on what those upgrades are. Things like special graphics, window tinting, smoked tail-lamps or other minor enhancements should be covered by the standard policy up to a grand. But beyond that, stuff it starts to get a little iffy.

“The thing that we get concerned with is anything that changes the way the vehicle drives, makes it less roadworthy or anything that’s not legal,” said Smidt. This means plunking a gigantic turbo in your sport compact, jacking your pickup truck skyward with a lift kit or putting race headers on your sports car are probably not going to be covered.

SEE ALSO: 10 Ways to Lower Your Insurance

Smidt said, “[If] you put something that’s illegal in your vehicle we’ll put it back to the way it was,” but if you get in an accident and file a claim they’re not going to replace components that break the law.

In simple terms this means you’re still covered in spite of any modifications you’ve made to your car or truck, the company simply won’t pay to replace those modifications.

But let’s say your vehicle has a bunch of upgrades, more than a grand that’s covered by one of Farmers’ standard policies. What are you supposed to do? “If you modify past that and did something [like] a special paint job or some interior equipment that was more than that, then there’s a customization endorsement that can be used,” said Smidt. Think of these as special add-ons to a standard policy.

To get an endorsement a customer would have to go and talk to a sales agent, walking them through the upgrades they’ve made to their vehicle. If the customer is eligible and the endorsement is available in their state, one of these extra-cost additions from Farmers will cover modifications up to $10,000.

SEE ALSO: Top 10 Cheapest Cars to Insure

Despite their willingness to work with customers that have vehicles with aftermarket enhancements there’s one thing they want absolutely NOTHING to do with. If you go racing or get involved in a speed contest of any kind, “There would be no coverage at that point,” Smidt said. This applies to things like track days and of course street racing, which is an incredibly stupid thing to do, though it makes us wonder if Vin Diesel’s Dodge Charger in The Fast and the Furious was covered in some way.

In addition to policy endorsements Farmers also offers specialty insurance products. If you’ve got a classic vehicle or a show car you could opt for something that’s known as a stated-value policy. Smidt said these “provide coverage up to the limit that the customer requests.”

Let’s say you have a ’67 Camaro and it’s got historical plates. You might insure it with one of these policies for $25,000; if it ever got totaled in a wreck you’d get a check for that amount.

When it comes to vehicle modifications Farmers’ main focus is getting customers to talk to their agents, and that’s good advice regardless of who your insurance carrier is. If you have special needs or require a unique policy to cover a modified car or truck company representatives can help guide you to the most appropriate policy.

GALLERY: Trucks of the 2013 SEMA Show

Discuss this story on our Luxury Lifestyle Forum.

Born and raised in metro Detroit, Craig was steeped in mechanics from childhood. He feels as much at home with a wrench or welding gun in his hand as he does behind the wheel or in front of a camera. Putting his Bachelor's Degree in Journalism to good use, he's always pumping out videos, reviews, and features for AutoGuide.com. When the workday is over, he can be found out driving his fully restored 1936 Ford V8 sedan. Craig has covered the automotive industry full time for more than 10 years and is a member of the Automotive Press Association (APA) and Midwest Automotive Media Association (MAMA).

More by Craig Cole

Comments

Join the conversation

You should have checked with other insurance companies... For example, State Farm DOES cover most upgrades such as turbos and lift kits. You will most likely get the actual cash value of items you have installed based upon a variety of factors... Again, if you are going to post something lumping insurance carriers into the same pool, you should have checked with the nations #1 auto insurer. They got that rank because they take care of people and don't get iffy when it comes time to pay a claim.

Farmers insurance is about as bad as they come. Very sad to see you used them as a example in this. How much did they pay you?